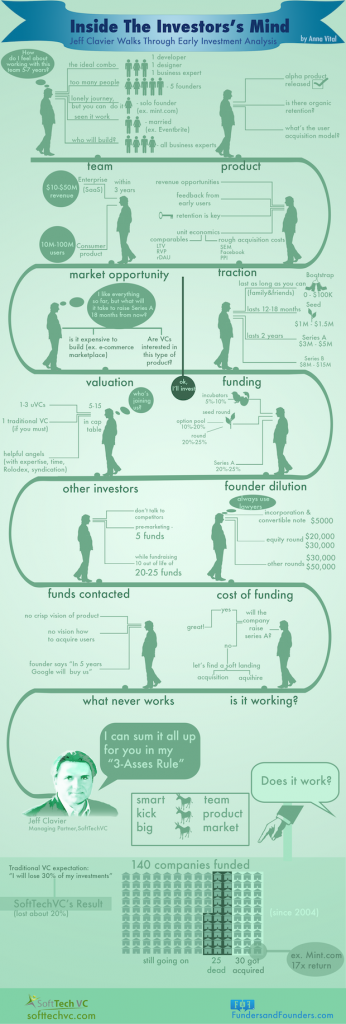

Inside the Mind of an Investor: The Three Asses Rule

Many of the business owners, and entrepreneurs I speak with have a desire to raise capital from angel investors, or venture capitalists. Though this is one way to grow a business (see my post on entrepreneur runways) this route is not the only route. I personally have never taken investment funding to grow any of my ventures. Nevertheless, learning about how top investors think can be very helpful to any business owner. Why do they choose to invest in one deal versus another? Though there are many answers to this question and each investor may differ in their answer, Jeff Clavier, managing partner of SoftTech VC, has an easy to remember approach that I find valuable.

The 3 Asses Rule…

I’ve also added an audio interview of Jeff speaking about this topic.

Jeff Clavier’s 3 Asses Rule is Very Solid…

Smart Ass Team

Kick Ass Product

Big Ass Market

It makes a lot of sense.

Another investor I spoke with years ago told me that they have a similar way they assess investment opportunities.

The Track – Rider – Pony approach.

Track – Market

Rider – Entrepreneur

Pony – Product

This philosophy works symbiotically with the 3 Asses Rule. A great entrepreneur (Rider) will build a “Kick Ass Team” that will uncover opportunities in “A Big Ass Market” (Track) and be able to win the race for success in that market with a “Kick Ass Product” (Pony).

I hope that you found these insights to be helpful!